The fundamental underlying theory of the accounts payable turnover rate (ratio) is based on an outdated retail model. Manipulation also occurs with the numerator. The above substitution method affects the denominator. Initially the shifting is within current liabilities once the credit is fully utilized, owners shift to longer term types of liabilities freeing up short-term accounts for further use. After extended periods of time with slow pay and the corresponding stress (vendor phone calls, extra notices, disgruntled suppliers) small business owners shift current liabilities to long-term notes via loans. In small business, the lack of working capitalor the extended working capital cycle forces the owner to delay or slow pay accounts payable. Substitution is the number one method used to manipulate the formula. What is interesting is that there are many different methods to manipulate the results. This reduces the average accounts payable and thus increases the turn rate. An outside reader would be misled as to the true ability of the company to pay its bills in a timely manner.Īnother aspect of this same principle is using credit cards to purchase necessary materials and supplies for sales. The A/P average decreases, increasing the turn ratio. Look at the following types of current liabilities :Ī simple draw on a line of credit and then using those proceeds (cash) to pay down accounts payable is effectively shifting the accounts payable to the line of credit. For accounts payable it is a matter of transferring the financial obligation by using a different type of current liability. For this formula it is essentially shifting the financial obligation to another venue. One of the basic business principles is called substitution. Is it a true and absolute measurement device? Let’s find out. Remember the key to this ratio is that it is used to ‘Measure the ability to pay bills in a timely manner’. the rate decreases increasing the average number of days to pay a bill.

If the average balance increases for payables and there is no change in sales, it symbolizes a slowing down of paying bills in a timely manner, i.e. This relationship between sales and the average accounts payable balance determines the ability of the company to pay its bills in a timely fashion. Notice that as the ratio increases, the cycle period decreases. At $3.6 Million in sales without an increase in the average payables balance the rate is 26.9 or a cycle period of 13.4 days. If sales (numerator) increases without a change in accounts payable average then the ratio will also increase. The following is the store’s accounts payable ending balance for 2015 by month and the final average.įenner’s sales for 2015 were $2.6 Million therefore the accounts payable turnover rate is:ġ9.40 equates to an average cycle of 18.5 days (360 days/19.4). Below is an illustration.įenner’s sells auto parts for foreign cars. Take the sum total of accounts payable and divided by 12 for the average. The rate is annual value and is the average of the twelve months ending balances.

THE UNDERLYING GOAL OF THE ACCOUNTS PAYABLE TURNOVER RATE IS TO MEASURE THE FREQUENCY (ABILITY) OF THE BUSINESS TO PAY ITS BILLS IN A TIMELY MANNER.Īcademia instructs students with the following as the accounts payable turnover rate (ratio) formula:Īccounts Payable Turnover Rate = Sales/Average Accounts Payable Balance This paper is designed to enlighten the reader to the formula’s benefits and drawbacks. It is easy to manipulate the results and there is proper application of the formula in business.

Accounts payable turnover for hotels full#

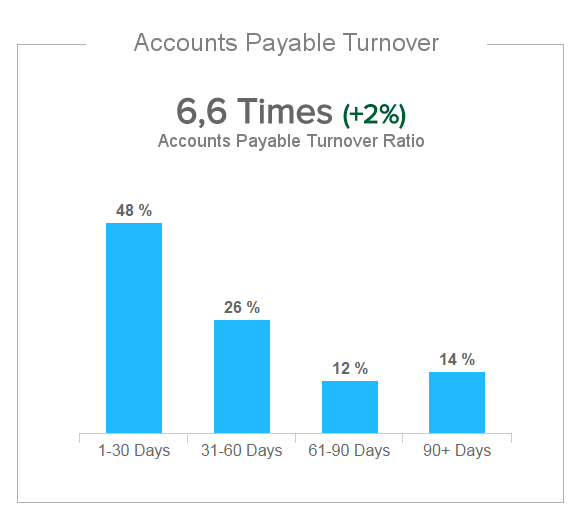

There are several fundamental principles involved with this ratio and as a business entrepreneur you should gain a full understanding of the formula. Ideal values exceed 20 as this indicates all accounts are paid on average at least every 18 days (360 days/20 = 18 days). A ’12’ would indicate that all payables are paid every month (360 days/12 = 30 days). The higher the number, the more often the payables are cleared (paid). The numerical value is customarily reported as an annual value. The accounts payable turnover rate is a business activity ratio measuring the frequency of the company’s ability to pay its vendors and suppliers.

0 kommentar(er)

0 kommentar(er)